AN OVERVIEW OF THE WASHINGTON APARTMENT MARKET

The regional Class A apartment market continues to be resilient despite increased competition and below-normal job growth, its performance fueled by shifts in demographics and lifestyle preferences for rental apartment living. While a high volume of new product will still be delivering over the next 12 months, the regional job market is showing signs of improvement and the demographic/lifestyle changes that favor rental apartment living show no signs of slowing down significantly, boding well for the apartment market over the next few years.

2015 Trends

Washington continues to experience record setting Class A absorption, as 12,623 Class A units were absorbed during the past 12 months – almost double the region’s 10-year average. Absorption including Class B product totaled 16,404 units, also a new record for the region.

Metro area Class A rents declined by 0.6% since March 2014, although low-rise rents remained unchanged.

The stabilized vacancy rate for all classes of investment grade apartments decreased by 60 basis points over the past year – currently at 4.2%; however, Class A vacancy rose slightly to 4.6%.

The 36-month development pipeline has plateaued, declining slightly from year-end to 38,943 units, with 33,123 of those units currently under construction.

Construction starts over the year decreased by 10% from the prior year to 10,712 units, as construction activity moderated in the second half of 2014.

Meanwhile, 12,353 units delivered over the past 12 months, similar to the prior 12-month period; however, 16,907 units are scheduled to deliver over the next 12 months.

FIRST QUARTER 2015 HIGHLIGHTS

• Stabilized vacancy for investment-grade apartments (Class A and B) in the Washington metro area decreased by 60 basis points from a year ago to 4.2%.

• Class A vacancy increased 10 basis points to 4.6% at March 2015.

• Rents for all investment-grade apartments are up 0.4% over the year.

• Class A rents are down 0.6%.

• Class B rents are up 1.9%.

• Annual Net Absorption, at 16,404 Class A and B apartments is record-setting for the region (191% above the long-term average) with positive absorption of Class B units coupled with the recent surge in Class A absorption. Washington recorded 12,623 Class A units absorbed over the past 12 months (a new record for the region).

Absorption of Class A units over the next 36 months will likely be significantly higher than the region’s 10-year annual average of 6,379 units. This projection is predicated upon the “de-nesting” and “un-grouping” of potential renters currently living with parents or roommates, along with job growth and the ratio of renters to owners staying the same or increasing.

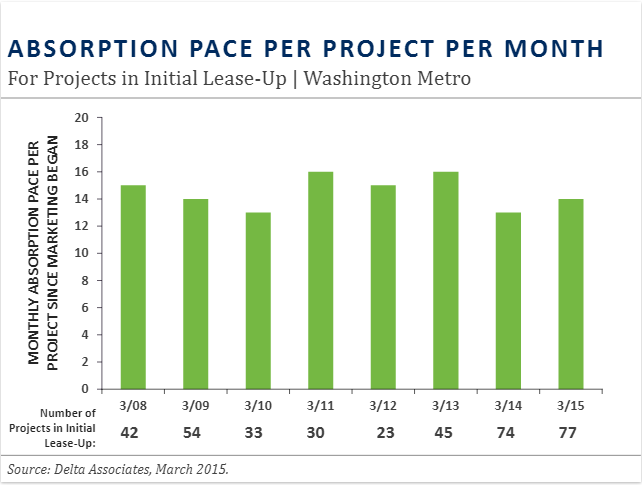

• Average per project monthly absorption of new projects increased to 14 units per month from 13 a year ago, despite the number of projects in lease-up growing from 74 to 77 over the past 12 months.

• The development pipeline edged down during the first quarter of 2015, currently at 38,943 units. Since 2013, the 36-month pipeline has hovered between 38,000 and 40,000 units, but we expect the pipeline to shrink to a more healthy level over the next 12 to 24 months as financial feasibility becomes more difficult in the face of rising construction costs and relatively flat rents. Fortunately, starts are down slightly over the past 12 months to 10,712 units; however, deliveries over the next year are projected to reach 16,907 units, an increase of more than a third from the last 12 months.